Smart Cities - How Energy Players Will Cohabit With Other Commodities Suppliers

The shift from the pure commodities to the Value-added services (VAS) in the Smart Cities.

All industry players are migrating to innovative services; Power and Gas providers to the energy monitoring, Telcos to the smart home services, device producers to the smart devices. These sectors (VAS) are more and more overlapped. Let's consider the offered range of VASs of an Energy provider, a Telco or a device producer...they are mostly the same.

Credibility

However, each of these players miss credibility on one aspect of the VASs: EnerCos lack of credibility in the connectivity, Telcos are not credible in the sector of content management, and device producers are typically too sector oriented.

In the smart city, these differences are accentuated; one example is the smart poles for the public lighting. They are owned and managed by EnerCos, wired by a fiber provider, crucial for the 5G repeaters of a Telco, and strategic for the city management (public security and safety, environmental control, traffic control); the same pole can also provide interesting data for the advertising (e.g. how many people with a certain profile pass in a specific location).

But what will be the business model in the near future? Who will manage all these applications and data? There will be common coordination or not?

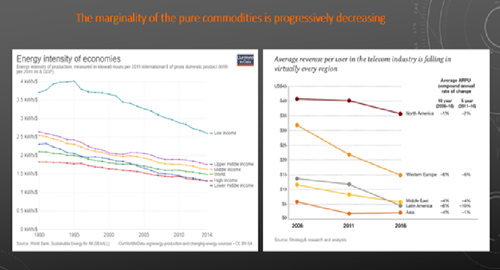

The marginality of pure commodities is progressively decreasing. This is true for all the commodities from power, to telecom, to gas and oil (exhibit 1).

Exhibit 1

In order to react to this trend, all players are moving from the pure commodity supply to the VAS offering. These are mainly enabled by the connectivity and simplify the key tasks, making them more efficient and lean (e.g. energy monitoring, smart home, machine to machine) – (exhibit 2).

Exhibit 2

The challenge

Nevertheless, the connectivity as enabler puts all these players in front of a credibility challenge; each one of them is particularly strong in managing a part of the “system”, but not the whole system... An energy supplier is particularly credible in the energy monitoring, less in the appliances automation; an appliance supplier is credible in automation, less in connectivity; a telecom company is credible in connectivity, less in the content management.

Unfortunately, very often, these players are competitors with comparable products (exhibit 3) and (an integrated solution is tough to be realised) and to identify an integrated solution is an arduous task.

Exhibit 3

Smart Cities

All the trends above are even more accentuated in the smart city concept. Even though a common definition of smart city is still far to be adopted; the concept is really simple and can be translated in a question: How to improve citizens' quality of life by leveraging the use of technology and networks?

This topic is becoming more and more “trendy” because of 3 main factors:

-

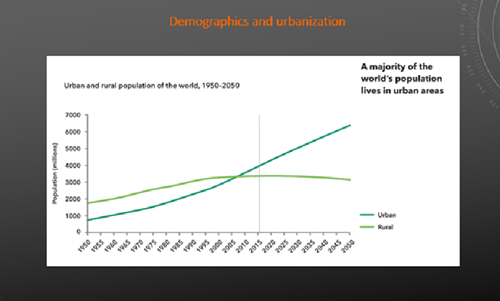

Demographics and urbanisation: cities are very attractive and people are moving towards them; in less than 40 years 75% of total global population will live in megacities (today less than 50%) – (exhibit 4)

Exhibit 4

-

Resource scarcity: cities are equipped with multiple systems to provide services to the citizens (transport, energy, water, etc.). These systems are strictly correlated: i) Energy depends upon water, ii) Transport upon energy, iii) 5G upon fiber, etc. (exhibit 5)

Exhibit 5

These systems managed separately, optimise every single function, but not the overall system “city”, generating a big waste of effort.

-

Technology: compared to 10 years ago, technology has grown at double-digit every year. Nowadays, everything could be connected and the related data analysed in real time.

These three factors have led many stakeholders (municipalities, private companies, governments, politicians) to study and create ecosystems (sometimes with some conflicts) able to put in place the smart city concept. (exhibit 6)

Exhibit 6

Examples of suitable applications in smart cities are parking sensors, connected buses, charging stations for electric cars, waste containers, etc.

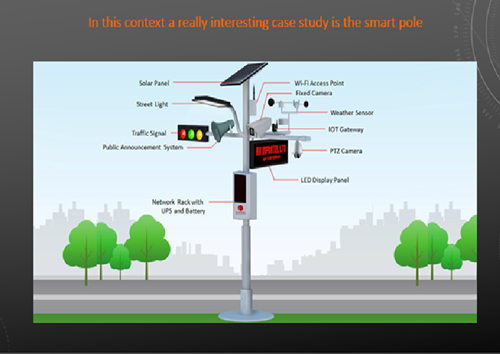

In this context, a really interesting case study is the smart pole, an intelligent, or multifunctional light pole, that can help solve many urban problems due to the ability to incorporate software controls, electronics and sensors that can receive and transmit data (exhibit 7).

Exhibit 7

One of the biggest advantages is capillarity: poles are everywhere and capillarity concept (in terms of data available and information) is one of the most interesting assets of the smart-city.

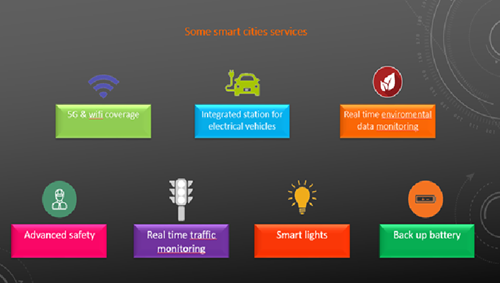

By replacing the traditional poles with smart ones, lots of modules and sensors are already available and are triggering different types of services for citizens and other stakeholders. For example:

- 5G & wifi coverage (one antenna every 50-80m is needed)

- Integrated station for electrical vehicles (cabled and secure positions are needed)

- Real time environmental data monitoring (e.g. detecting temp and weather changes)

- Advanced safety (smart cameras for car accidents, shops monitoring, Real-time data communications with low latency, etc.)

- Real time traffic monitoring (sending info about traffic to a data centre)

- Smart lights for automatic brightness adjustments (aimed to reduce the cost of energy consumption)

- Back up battery (as solar power solution or with Lead Acid or Li-Ion batteries for green energy saving and giving uninterrupted power)

In this context, who could be the players potentially interested in the management of these appliances? They could be countless... energy players could be interested in monitoring the urban energy system and even more often in managing the footprint of the e-mobility. Telecom companies could be interested in 5G coverage and big data management. Local authorities could be interested in the traffic management, safety and security control. Fiber providers could be interested in positioning the cables as the real enabler of the services; advertising agencies could be interested in the dynamic targeted advertising.... and the list could be endless! It is clear how these interests may overlap, and could create conflicts, making the e-cities management more challenging (exhibit 8).

Exhibit 8

The real challenge comes when these factors come together, transforming conflicts and overlaps into synergies. Traffic monitoring could be interesting to forecast e-mobility utilisation, fiber could be the enablers of 5G aerials, pedestrian data could be the basis for the dynamic advertising, and many others. Different business models could benefit from these synergies, and bring the smart cities “all in one” (Exhibit 9).

Exhibit 9

Coming back to the smart pole business case, three alternative business models could be designed.

The first is that local municipalities will replace the traditional poles and they will be the only beneficiaries (managing the services for citizen and maybe selling available data to private companies).

Pros: 1) Local municipalities have direct control over data; 2) Municipalities have an additional revenue stream in case of data sold to private companies

Cons: 1) Municipalities have to manage the complexity of the transition from traditional light pole to smart ones; 2) Typically they are not able to sustain the replacement investment

The second is that the pole replacement is managed by a third party player (e.g.; a general purpose service provider, as Cisco) who provides Value Added services. Part of the energy saving is reverted to the municipality and a part is used to repay the investment. All the revenues from the VAS are earned by the service provider.

Pros: 1) Municipalities don’t have to invest in the technology and to manage the transition towards smart poles

Cons: 1) Low margins if the third party is a pure intermediary; 2) Municipalities don’t fully benefit from energy saving; 3) Potential conflicts with the local communities

The last is a financing project put in place by the smart pole provider; all the value- added services firstly will repay the project financing and only after it will generates incomes that could be partially reverted to the municipality.

Pros: 1) The absence of intermediaries allow smart pole provider to act as the unique reference

Cons: 1) Municipalities don’t fully benefit from energy saving; 2) Potential conflicts with the local communities

Conclusions

There are key questions the players have to answer as soon as possible to make the Smart Cities really effective and efficient:

- Who are the best coordinator for all these Value Added Services?

- How can the cities be segmented in terms of services and business model?

- How the politics could be involved in this game?

- Is the public opinion ready or it needs educational?

Gianfranco Scalabrini is a Visiting Professor at the ESCP Business School in London; Managing Partner of 3H Partners and Member of the EMC Advisory Board.

Interested in becoming an energy expert and make a real impact in the industry? Check out how ESCP's programmes will equip you with the tools you'll need!

Facebook

Facebook Linkedin

Linkedin Instagram

Instagram Youtube

Youtube EMC Newsletter

EMC Newsletter