Risk management in the energy industry: the need for a performance indicator

Considering the increased complexity of energy projects as companies are entering a new technological era marking the end of "easy oil", there is a growing concern about the real preparedness of companies to deal with the new risks they are facing. The potential severity of those risks due to the important damages caused to the environment and their possible impact on populations explain this apprehension. Furthermore, the mis-handling of recent catastrophes by large energy companies - as well as the largely unpublicised leaks - have cast serious doubts as to their ability to prevent severe accidents from occurring and if they do to control their development [1].

Though most energy companies have now put in place a risk management organisation and rigorous risk control systems, mostly to comply with new laws and regulations, the lessons drawn from the recent past indicate that it did not result in much improved safety performance [2]. In fact compliance is not enough; it does not guarantee that risks are effectively under control [3]. Most accidents are explained by transgression of safety rules and procedures, excessive risk taking or simply risk blindness. It demonstrates that risk management rules and procedures may exist but are not always taken seriously enough within organisations. Why is it so? Partly because efforts made in this domain are not reflected in the value of the company but rather have a negative impact on usual financial performance indicators.

More or less, preventive measures aiming at reducing the risk exposure of the company have a cost, and therefore contribute to the deterioration of performance indicators, whereas there is usually no clear assessment of their positive impact. Hence there is an incentive to postpone or just ignore safety measures. For instance postponing an expensive maintenance programme may be the solution to achieve a targeted return on equity or preserve the level of operating cash-flows for the current year, yet it may prove dangerous. Would the resulting increased risk exposure due to poor maintenance be identified and reported the decision might be different.

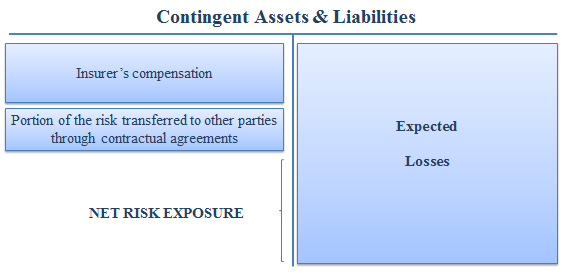

On the exhibit below we indicate the components of the "net risk exposure" for a company which is made of contingent assets and liabilities. Prospective losses can be treated as contingent liabilities for a value equal to the expected losses1; on the other side guarantees acquired from insurers or resulting from contractual agreements with other parties should be seen as "contingent assets" compensating for a part of expected losses. The difference is the net risk exposure.

Developing an efficient risk management programme would indeed reduce expected losses and/or increase guarantees and hence increase the equity value2. If investors are well informed on a perfect market, this risk reduction would be reflected in a "marked to market" value of the firm. But indeed rather than perfect information ambiguity dominates. Moreover financial analysts who are expected to provide investors with relevant information do not seem to pay much attention to the issue as anyone can observe when reading their notes. Yet, when potential losses can represent billions of euros - as it is the case for energy companies exposed to the risk of fatalities and severe environmental damages - it might be a good way forward. In particular, any attempt to value the quality of risk management, would be a good move. Arisk management performance indicator would inform stakeholders about the probability and severity of potential accidents, have an influence on conditions negotiated with business partners, on the cost of debt and eventually on the share price. Undoubtedly companies would regard such an indicator seriously.

In this domain, insurers can have a major role since they are normally familiar with risk assessment and pricing. Considering the increasing cost of claims in the energy industry - particularly if liability caps are increased or even removed [4] - they may well think of it.

[1] Oil and gas spills in North Sea every week, papers reveal,Richard Cookson Tuesday 5 July 2011.

[2] Enterprise risk management lessons from the BP Deepwater Horizon catastrophe, June 2010.

[3] Patrick Gougeon, Ignore risk management at your peril, Financial Times, March 28, 2011

[4] Raise BP liability cap to $10 billion?

1. For well diversified shareholders this would be the appropriate measure assuming accidental risk are not correlated with the market portfolio.

2. Only if the additional cost incurred is lower than the decrease in expected loss.

Facebook

Facebook Linkedin

Linkedin Instagram

Instagram Youtube

Youtube EMC Newsletter

EMC Newsletter