The Post-COVID-Pandemic World: What Could the Global Economy & the Oil Industry Expect?

2020 will enter history books as the year of the COVID-19 pandemic which has inflicted the biggest damage on both the global economy and the global oil market since the Great Depression of 1929.

It will change the way we live in more ways than one. If anything, the pandemic has proven irrevocably how inseparable oil and the global economy are by demonstrating that destroying one automatically destroys the other and vice versa. 1

The pandemic was a crisis like no other according to Kristina Georgieva, Managing Director of the International Monetary Fund (IMF), causing the global economy to shrink by 4.4% in 2020 which would mark the worst downturn since the Great Depression and sending an additional 114 million people into extreme poverty, defined as living on less than $1.90 a day. 2 Furthermore, it has led to a virtual collapse of the global oil and gas industry causing global oil demand to decline by an estimated 30 million barrels a day (mbd) or 30% of pre-pandemic demand of 101 mbd. 3

Geopolitically, the pandemic has shown an aspect of rivalry between the United States and China and might have sharpened the race for the next world order and who will emerge the dominant power of the 21st century. 4

Almost a year after the pandemic started and the global rollout of vaccines has raised hopes that the global economy will soon return to its full economic activities, governments around the world and experts are counting the actual damage suffered by the global economy and the rising unemployment particularly among the young.

The overarching trend over the next decades is an expanded role of governments. The pandemic response and recovery have necessitated larger government expenditure, both on healthcare response and in supporting households and businesses through the crisis. These, in turn, require significant government investment. So does the redeployment of workers from sectors severely affected by the pandemic to emerging sectors.

In 1932 John Maynard Keynes - the most-famous economist at the time - wrote an essay entitled “Economic Possibilities for our Grandchildren.” The Great Depression of 1929 was raging at the time, just as the pandemic is now, and Keynes was worried about what he described as technological unemployment —unemployment due to new technology replacing or economizing the use of labour. This fear is alive now, too, as shoppers go massively online and shopping malls are going bankrupt.5

The Role of Governments in Stimulating the Global Economy

Governments of the major economies in the world have been focusing on assisting existing businesses weather the crisis and save jobs. Less is done to help new companies grasp employment opportunities as they emerge. Yet, economic crises are periods of creative destruction, where new ideas and ways of doing things come to the fore.

Some of the new opportunities are just a different – technology-based – way to do the same business, just as Keynes predicted. Firms have invested in digital applications. Workers have learned how to use remote databases and reach their customers over social media. The office was becoming virtual even before the pandemic and may remain so post-pandemic in some economic sectors.6

For example, in the United Kingdom, 20% of new businesses created in the third quarter of 2020 were in retail, which reflects an increase in online shopping during Covid-19. Besides retail, industries that are adaptable to remote work also took a larger share of business creations in 2020 than before. There is also the possibility that entirely new sectors emerge after the pandemic. These, in turn, may create new ways to do business with the public administration, simplifying the interactions between business and governments.

Several governments have established programmes to aid new business formation during the pandemic. Early results suggest that these programmes may be working. The number of new business applications in the United States shot up by 27% in 2020 relative to the same period in 2019. Significant increases in entrepreneurship are also recorded in Turkey (23%), Chile (14%) and the United Kingdom (8.5%). New businesses may shepherd industries that become more efficient and create entirely new industries. Governments can ease their path.

In the United States, President Joe Biden unveiled a $1.9 trillion fiscal stimulus plan. The EU’s two largest economies Germany and France also announced economic packages estimated at 130 billion euros and 100 Billion euros respectively focusing on green technology investment, more support for workers and firms, and industrial policy reforms.

By contrast, most developing countries are burdened by deficits and cannot borrow readily to finance such programmes. Instead, many are following the pattern of Brazil, China, India, and Russia (BRICs) and spending on bricks and mortar rather than business and income support.

The four BRICs are at different stages in recovery. China is the only major economy in the world to record growth in 2020. The IMF forecasts an economic growth of 8% for China, 8.3% for India and 4.1% for Russia in 2021. Brazil lacks a recovery with its economy shrinking by 9.1% in 2020 and remaining stagnant in 2021.

The BRICs’ approach to recovery relies largely on stimulating investment through large-scale infrastructure projects. This makes sense as governments can decide how many kilometres of railway or roads to build and do so through emergency procurement procedures. As examples of infrastructure projects, China is building 4,000 km of railway in 2020-21, half for high-speed trains. Russia has announced a programme for upgrading the Trans-Siberian railway, a dozen Siberian airports, and three Black Sea ports by 2024. Brazil and India plan to finance infrastructure investments by attracting foreign direct investment (FDI) and generating additional revenues from privatizing state-owned companies.

2021 could be the year that the global economy’s growth will accelerate and recoup most of its losses and that global oil demand will witness a speedy growth taking oil prices to $60-$70 a barrel.

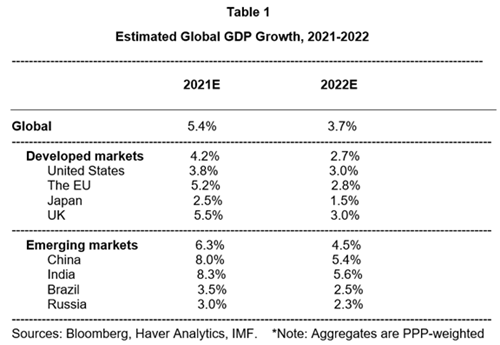

The global economy is projected to grow by an estimated 5.4% in 2021 and 3.7% in 2022 led by emerging markets particularly China and India (see Table 1).

And with a probable end to the trade war between the US and China and a possible de-escalation of tension between Iran and the United States and also in the Eastern Mediterranean, the world and the global economy will get a breather to readjust to the post-pandemic era.

Going back to the predictions of the great economist Keynes, he was correct to worry about technological unemployment 90 years ago. Yet his worry has not withstood the test of time. People and economies find new and exciting ways to engage in productive activities by developing their human capital and adapting to new consumer demands. The Covid-19 crisis is no different – new opportunities are already emerging. This time, just as after the Great Depression, governments are called upon to help workers and businesses transition to the new economy.

The Oil Industry in a Free Fall

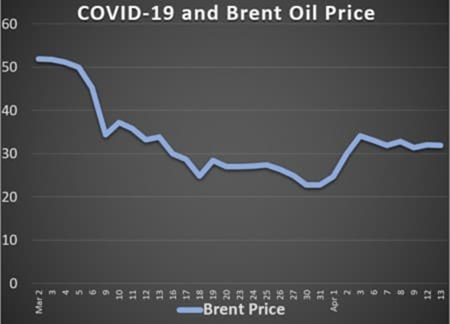

Estimates of the damage to the global oil demand vary but they overwhelmingly agree that the glut in the global oil market has mushroomed to an estimated 1.4 billion barrels in 2020 and the global oil demand has declined by an estimated 30 mbd with oil prices crashing to mid-$20s (see Chart 1).

Source: Courtesy of Investing.com accessed on 18 April, 2020

With oil prices in a free fall, only OPEC+ stood between the destructive power of the pandemic and the collapse of the global oil market and the whole oil industry. OPEC+’s huge production cuts of almost 10 mbd in May 2020 put a solid floor under oil prices and prevented them from sinking below $20 a barrel and also saved the global oil market.

Since then crude oil prices have been on the rise with Brent crude surging above $64 a barrel for the first time since 2019. Brent is projected to hit $70-$80 by the third quarter of 2021 and average $65 this year. Moreover, global oil demand is projected to return to pre-pandemic level of 101 mbd by the middle of this year.

Oil prices are now underpinned by strengthening fundamentals of the global oil market, an accelerating depletion of global oil inventories from 1.4 billion barrels to an estimated 100 million barrels now, a near total compliance of OPEC+ production cuts, the prospects that the global economy will return soon to its normal economic activities as a result of the global rollout of vaccines and China’s and India’s unquenchable thirst for oil.

China to the Rescue

The pandemic has highlighted China’s role as the undisputed driver of both the global economy and the global oil demand. China was the first to go into lockdown but it was also the first to exit it.

China’s spectacular rebound has been instrumental in both the surge in global oil demand and prices. China will continue to be the real driver of both the global economy and global oil demand well into the future aided by India.

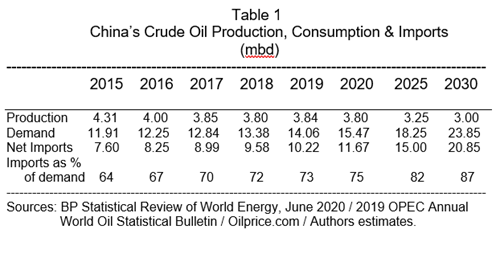

Its speedy rebound has astounded the world coinciding with the shutting down of most of the world’s economy. Moreover, China’s crude oil imports broke all previous records averaging 11.67 mbd in 2020, 10% higher than the same period in 2019 despite the pandemic. 7

Two quintessential objectives will continue to occupy China’s strategic thinking well into the future. The first is securing its oil and energy needs peacefully. The second is ensuring its energy security.

The struggle between the world’s third largest oil producer (the United States) and the world’s biggest oil importer (China) will have huge implications for the entire world’s energy markets and the global economy in general.

The most recent battlefield is Iraq, the second largest oil producer in OPEC after Saudi Arabia. China’s interest in buying ExxonMobil’s 32.7% stake in Iraq’s supergiant West Qurna 1 oilfield will result in its control of three of Iraq’s supergiant oil fields, namely Majnoon, Rumaila and Qurna 1 oilfields. And by taking over the contract for the crucial Common Seawater Supply Project (CSSP) which ExxonMobil isn’t keen to go ahead with, China will virtually be in control of Iraq’s oil industry. The CSSP is pivotal for Iraq’s plans to raise its production to a minimum of 7 mbd and a maximum of 12 mbd by transporting sea water from the Persian Gulf to oil production facilities to boost the pressure and recovery rates at key oil reservoirs in Iraq.8

Since it became a net oil importer in 1993, China has greatly increased its oil imports from 20,000 barrels a day (b/d) then to an average of 11.67 mbd in 2020 accounting for 75% of its consumption and this is projected to rise to 87% by 2030 (see Table 1).

Oil Markets in the Aftermath of the Coronavirus

The global oil markets will undergo some radical transformation in the aftermath of the pandemic. Major players like Saudi Arabia and Russia will have greater sway over the global oil market in the aftermath of the pandemic. The influence and importance of the US shale oil industry will decline whilst the global oil industry will emerge leaner and smaller but it will continue also to have sway over the global oil market in terms of oil and gas projects.

OPEC+’s prestige, influence and control of the global oil market will be enhanced further with positive impact on the stability of both the market and crude oil prices.

China and India will be the real drivers of the global oil market and prices.

Saudi Arabia & Russia

Saudi oil strategy is to enhance its market share in both China and the EU. However, Russia has been gaining market share at the expense of Saudi Arabia first because China has vested strategic interests with Russia and second because Russian piped oil exports to China are cheaper than Saudi shipped oil exports particularly at a time of rising shipping rates. Russia retains the same advantage in the EU for its oil and gas exports. 9

Russia is of great interest to China not only because it is a major supplier of crude oil, gas and LNG to it but also because it is a quintessential partner under the China-Russia strategic alliance.

Russia owns and runs oil and gas pipelines to China providing vast quantities of crude oil, natural gas as well as LNG. This helps China overcome issues of energy security related to crude oil shipments from the Gulf having to pass through the very critical chokepoints of the Straits of Hormuz and Malacca.

And despite the fact that Saudi and Russian oil strategies might diverge from time to time, their cooperation under the banner of OPEC+ will enhance their influence in the global oil market and will ensure the stability of prices and the market.

The US Shale Oil Industry

The US shale oil industry was devastated by the pandemic. It was the most hit industry. It will emerge from the pandemic leaner and weaker but will continue to need a life support machine paid for by American taxpayers to survive.

Since its inception, the US shale oil industry’s work ethics was characterized by greed and irresponsible production aimed at undermining OPEC+ efforts to prop oil prices and also gain market share at its expense. But that approach has resulted in increasing numbers of bankruptcies, mounting debts estimated at hundreds of billions of dollars and a loss of investors’ confidence culminating in a virtual collapse during the pandemic.

Former President Trump encouraged shale oil drillers to put geopolitics ahead of economics. He urged them to adopt empty slogans of his discredited “America First Policy” such as ‘achieving US energy dominance’, ‘making America oil self-sufficient’ and ‘claiming America the world’s largest crude oil producer’ thus encouraging them to produce recklessly and in so doing destabilizing the global oil market and prices and accelerating the eventual demise of their industry.

With a breakeven price of between $60 and $65 a barrel for most drillers, US shale oil could hardly expect to stage a comeback soon.

The crucial situation facing the shale oil industry is that its fate is now in the hands of OPEC+. Were OPEC+ to end its production cuts for any reason, prices will fall and this will immediately and very adversely impact on shale oil production.

OPEC+

September 14, 2020 marked the sixtieth anniversary of the Organization of the Petroleum Exporting Countries or OPEC — almost two thirds of a century of existence characterized by embargo, conflict and even wars. But the biggest challenge OPEC has ever faced since its founding was the pandemic.

Only OPEC+ stood between the destructive power of the pandemic and the collapse of the global oil market and the whole oil industry. OPEC+’s efforts have saved the day and earned worldwide acknowledgement even grudgingly by the United States.

The Emerging New World Order?

More than two centuries ago, Napoleon Bonaparte uttered a wise dictum that “China is a sleeping giant. Let her sleep, for when she wakes she will move the world’. Now this giant is hell-bent on dethroning the United States as the ‘indispensable superpower’ and establishing a new world order.

During his four years in the White House, former President Trump has placed blame squarely on China for a wide range of grievances including intellectual property theft, unfair trade practices and recently, the COVID-19 pandemic. Trump even insisted on calling the pandemic the “China virus” and vowed that China is going to pay for what the pandemic has done to the United States. Early on he started a trade war against China.

The Pandemic may have sharpened the race for a new world order. And whilst it may have shown an aspect of rivalry between the United States and China, their rivalry goes far beyond the pandemic. It is about the next world order and who will emerge as the dominant power in the 21st century. It is also about the petro-yuan supplanting the petrodollar as the oil currency of the world.

The inevitable rise of China is underpinned by the Russian-Chinese strategic alliance, the Belt and Road Initiative (BRI) and the growing importance of the petro-yuan.

Russia and China share a strategic vision against the unipolar world: both see the United States in relative decline and the world already becoming multipolar. In the process of mismanaging its decline, the US suffers from a psychological problem that manifests itself in the unfounded fear of power challenge from potential rivals, hence its persistent attempts to hinder their rise. The world is changing and the world order must be revamped. Pax Americana is over and Washington must adjust to the new world.

The BRI has enabled China to integrate its economy in the global trade system far more than the United States’. Moreover, by offering loans and helping most countries of the world modernize their infrastructure and starting wealth-creation projects, China’s economy is benefiting immensely by expanding the market for its global trade. That is why China won Trump’s trade war against it. .

Meanwhile, China has been doing its part to undermine the petrodollar. In March 2018 it launched the petro-yuan to undermine the petrodollar in global oil trade and thus undermine the US financial system.

This leads me to conclude that the indispensability of the United States is eroding fast with an emerging new world order beckoning. This new multipolar order is led by the China-Russia strategic alliance.

Furthermore, it is probable that the Chinese yuan will emerge as the world’s top reserve currency within the next two to three decade with the petro-yuan dominating global oil trade.

A Glimmer of Hope

The widening global vaccination is raising hopes of mankind that an end of the pandemic is near. Furthermore, the speed by which scientists around the world managed to develop the vaccines speaks volumes of advances in technology and the indomitable will of humanity to put this sad chapter quickly behind them.

Lessons to Be learnt

If anything, the pandemic has proven irrevocably the inseparable link between the global economy and oil. By destroying one you destroy the other and vice versa.

Oil and gas will continue to be the fulcrum of the global economy and the core business of the global oil industry throughout the 21st century and probably far beyond.

2021 could be the year that the global economy’s growth will accelerate and recoup most of its losses and that global oil demand will witness a speedy growth taking oil prices to $60-$70 a barrel.

*Dr. Mamdouh G. Salameh is an international oil economist. He is one of the world’s leading experts on oil. He is also a visiting professor of energy economics at the ESCP Business School in London.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the position of ESCP Business School.

***

Footnotes

1. Mamdouh G Salameh, “Oil Markets in the Post-Pandemic World: Current Prospects & Future Challenges” (An E-lecture given at the invitation of Trends Research & Advisory in Abu Dhabi, UAE on 29 April, 2020).

2. Martin Crutsinger, “A Crisis Like No Other: IMF Warns Global Economy Could Be Permanently Scarred” published by the Sydney Morning Herald on 16 October 2020.

3. Mamdouh G Salameh, “Oil Markets in the Post-Pandemic World: Current Prospects & Future Challenges”.

4. Ibid.,

5. Simon Djankov, “\the World After COVID-19: From New Economic Trends to Old Inequalities” published by Trends Research & Advisory, Abu Dhabi, UAE, 14 February 2021.

6 Ibid.,

7. Based on figures published regularly by Oilprice.com and accessed by the author.

8. Mamdouh G Salameh, “What a Momentus Year 2020 Has Been?” posted by the Hellenic Association for Energy Economics (HAEE) on 28 December 2020.

9. Mamdouh G Salameh, “Oil Markets & the Shifting Interests of Major Players” (an article published on the 21st of May 2020 by the Insights of Trends Research & Advisory, Abu Dhabi.

Facebook

Facebook Linkedin

Linkedin Instagram

Instagram Youtube

Youtube EMC Newsletter

EMC Newsletter