Will the Petro-Yuan be the Death Knell for the Petrodollar?

The 26th of March 2018 will go in history as the most momentous day for the United States’ economy, China’s economy and the petrodollar and also for China’s status as an economic superpower. In that day China launched its yuan-denominated crude oil futures in Shanghai thus challenging the petrodollar for dominance in the global oil market. And in that very day 15.4 million barrels of crude for delivery in September 2018 changed hands over two and a half hours—the length of the first-day trading session for the contract.

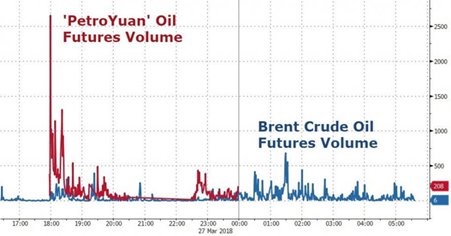

Exactly one week after China launched its crude oil futures, the petro-yuan surpassed Brent trading volume. How long will it take it before overtaking the petrodollar? (see Chart 1).

Source: Courtesy of Oilprice.com (accessed on 2 April 2018).

China has been planning for years to dethrone the US dollar. The truth of the matter is that China does not plan to allow the US financial system to dominate the world indefinitely. Right now, China is the number one exporter on the globe and the largest crude oil importer in the world and also the world’s biggest economy with a GDP of $23.57 trillion in 2017 (compared to $19.38 trillion for the US), based on purchasing power parity (PPP).

The Chinese would like to see global currency usage reflect this shift in global economic power. At the moment, most global trade is conducted in US dollars and more than 60% of all global foreign exchange reserves are held in US dollars. This gives the United States an enormous built-in advantage but thanks to decades of incredibly bad decisions, this advantage is starting to erode.

Today, the US financial system is the core of the global financial system. The petrodollar provides at least three immediate benefits to the United States. It increases global demand for US dollars. It also increases global demand for US debt securities and it gives the United States the ability to buy oil with a currency it can print at will. In geopolitical terms, the petrodollar lends vast economic and political power to the United States.

So if the US financial system is the core of the global financial system, then US debt is "the core of the core". US Treasury bonds fuel the print-borrow-spend cycle that the global economy depends upon. That is why a US debt default would be such a big deal. A default would cause interest rates to skyrocket and the entire global economic system to go haywire.

Unfortunately for the United States, US debt is growing far more rapidly than GDP is, and therefore the debt is completely and totally unsustainable. The Chinese understand what is going on, and when the dust settles they plan to be the last ones standing. And China is not just going to sit back and wait for all of this to happen.

If the petro-yuan manages to take a 25% share of the global oil market estimated at $14 trillion, US outstanding debts could rise immediately from the current $21 trillion to $28 trillion with huge repercussions for the US economy and the value of the dollar.

How big a threat is the petro-yuan to the petrodollar?

Back in 2015, the first of a number of strikes against the petrodollar was dealt by Russia. Gazprom Neft, the third-largest oil producer in Russia, decided to move away from the dollar towards the yuan and other Asian currencies. Iran followed suit the same year accepting the yuan for payment for Iranian oil exports.

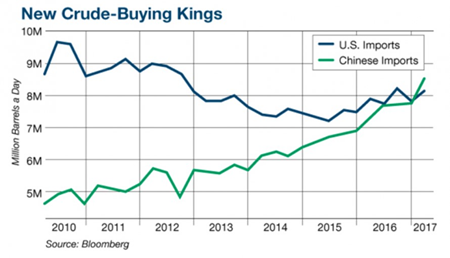

A death blow that began in 2015 hit again in 2017 when China became the world’s largest importer of crude oil (see Chart 2)

With major oil exporters finally having a viable way to circumvent the petrodollar system, the US economy could soon encounter severely troubled waters. First of all, the dollar’s value depends massively on its use as an oil trade medium. When that is diminished, we will likely see a strong and steady decline in the dollar’s value.

The petrodollar is backed by Treasuries so it can help fuel US deficit spending. Take that away, and the US economy will be in trouble leading to a loss of value of the dollar against other currencies. Contrast this with a petro-yuan convertible to gold.

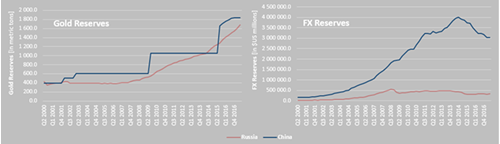

China has effectively cornered the market for physical gold in support of the petro-yuan (see Chart 3).

Chart 3

China’s Gold Reserves

Source: Courtesy of World Gold Council.

The launching of the petro-yuan could be a “wake up call” for the United States. Moving oil trade out of the petrodollar into the petro-yuan could take initially between $600 billion and $1trillion worth of transactions out of the petrodollar. Maintaining the petrodollar is America’s primary goal. Everything else is secondary.

Will the petrodollar survive the petro-yuan?

It is becoming clear, at least to independent monetary observers, that in 2018 the petrodollar’s primacy is being challenged by the petro-yuan as the pricing medium for oil and other key industrial commodities. After all, the dollar’s role as the legacy trade medium is no longer appropriate, given that China’s trade is now driving the global economy, not America’s.

At the very least, if the dollar’s future role diminishes, then there will be surplus dollars, which unless they are withdrawn from circulation entirely, will result in a lower dollar on the foreign exchanges. While it is possible for the US Federal Bank to contract the quantity of dollars circulating around, it would also have to discourage and even reverse the expansion of bank credit, which would be judged by central bankers to be economic suicide. For that to occur, the US Government itself would also have to move firmly and rapidly towards eliminating its budget deficit. But that is being deliberately increased by the Trump administration instead.

The Bretton Woods agreement, designed to make the dollar appear “as good as gold”, was a cover in the past for US Governments to fund wars in Korea and Vietnam and other foreign adventures by monetary inflation, which they did without restraint. That practice ended in 1971 with the discarding of the international gold standard. Today the ratio of an ounce of gold to the dollar has moved to about 1:1350 from the post-war rate of 1:35, a huge loss of the dollar’s purchasing power.

Since the Nixon shock in 1971, the Americans have been adept at perpetuating the myth of the mighty dollar, insisting gold now has no monetary role at all. By cutting a deal with the Saudis in 1973, Nixon and Kissinger ensured that oil, and in consequence all other commodities, would be priced in dollars. Global demand for dollars was assured, and the banking system of correspondent nostro accounts meant that all the world’s trade was settled in New York through the mighty American banks. And having printed dollars to ensure higher oil prices would be paid, they would then be recycled as loan capital to America and its allies. The world had been bought, and anyone not prepared to accept US monetary and military pre-eminence would pay the price.

That was until now. Once the process starts, triggered perhaps by the petrodollar’s loss of its trade settlement monopoly, it is not beyond the bounds of possibility for the dollar to initially lose between a third and a half of its purchasing power against a basket of commodities, and a similar amount against the yuan, which is likely to be managed by the Chinese to retain its purchasing power.

Hitherto, the US dollar has had the monopoly over oil contracts as it enjoyed the status of the only currency in which major oil contracts could be made. This meant that US could get away by having a $21 trillion budget deficit as it could print the dollars backed by “black gold”.

With the petro-yuan a reality now, China will, in effect, be making a claim to global oil reserves. That would definitely be against American interests as the “black gold” has been practically backing the US dollar as well as a humungous US debt.

While Russia and China have stepped up their alliance to a level where the Russian ruble is an acceptable tender at many places in China, many other countries sitting on oil reserves are naturally averse of petrodollar. Iran and Venezuela are constantly battling sanctions hurled at them by the United States. Both Iran and Venezuela could have a great economic outlook had it not been for the petrodollar.

To delay or halt its economic decline, America has every reason to embark on military adventures possibly triggering a war in Syria, Iran or North Korea, for example.

Are the petrodollar’s days numbered?

Today, the geopolitical sands of the Middle East are rapidly shifting. The faltering strategic regional position of Saudi Arabia, the rise of Iran (which is not part of the petrodollar system), failed US interventions, Russia’s increasing power as an energy giant and the emergence of the BRICS nations (Brazil, Russia, India, China & South Africa) which offer the potential of future alternative economic/security arrangements, all affect the sustainability of the petrodollar system.

One needs also to be aware of what Vladimir Putin is doing. Putin would like nothing more than to sabotage the petrodollar, and he’s forging alliances across the world that he hopes will help him achieve his goal.

The US is really not importing much Arab oil anymore. If that were the case, it’s really hard to see why the Arabs would continue to price their oil in dollars, especially that their biggest customers would be China, Japan and other Asia-Pacific countries that have no particular reason to deal in dollars.

Meanwhile, the world’s leading oil importer -China- is doing its part to undermine the petrodollar. In recent years, China has been striking agreements with many of its trade partners to do business using each other’s currencies. China and Russia, China and Brazil, China and Australia, even China and its old/new enemy Japan — they all have currency swaps and other arrangements in place to bypass the dollar. The launch of China’s crude oil futures contract is the culmination of a series of steps taken by the Chinese to dethrone the petrodollar.

A Petro-Yuan fully convertible to gold on the Shanghai and Hong Kong exchange brings a stable confidence frame to support what may very well become “Oil for Gold” or “Petro-Yuan for Gold”.

A decreasing demand for the petrodollar (in effect devaluating it against other reserve currencies) would result in an increase in interest rates of US bonds, a rise which would cause severe budgetary issues to the US. It would also decrease significantly the effect of US sanctions.

This is critically important, because once the dollar loses its coveted reserve status, the consequences will be dire for Americans. At that moment, Washington will become sufficiently desperate to enforce the radical measures that governments throughout world history have always implemented when their currencies were under threat including wars.

One must also consider the strong connection the US dollar has with its country’s culture. Any significant change in their status quo due to this issue, is bound to generate a strong (with Donald Trump perhaps even unproportioned) response.

Could the petro-yuan unseat the petrodollar?

It won’t be easy to unseat the petrodollar without the participation of some major oil producers like Russia and Saudi Arabia. Between them Saudi Arabia and Russia account for 26% of global oil production and 25% of oil exports. Russia is already on board along with Iran and Venezuela.

China is now trying to persuade Saudi Arabia to start accepting the petro-yuan for its crude oil. If the Chinese succeed, other oil exporters could follow suit.

Saudi Arabia currently sells a little more than 1 million barrels of oil a day (mbd) to China. Russia is still the top supplier to China, exporting 1.55 mbd and, in fact, Russia has been taking market share away from Saudi Arabia in China. If Riyadh wants to avoid losing more ground, it may have to agree to petro-yuan sales. For Saudi Arabia, it will find itself between a rock and a hard place – lose the Chinese market or spark the ire of Washington.

On balance, I think Saudi Arabia will compromise by accepting the petro-yuan for oil exported to China and the Asia-Pacific countries whilst continuing to accept the petrodollar for exports to the European Union (EU) and the United States. Even such a compromise will still tip the balance in favour of the petro-yuan since 75% of Saudi oil exports go to China and the Asia-Pacific region.

A possible petro-yuan/petrodollar confrontation?

The launching of the crude oil benchmark on the Shanghai exchange could mark the beginning of the end of the petrodollar. The United States is not going to take this potential threat lying down.

That is why the recent imposition of tariffs on Chinese exports could be viewed as the first shots in the petro-yuan/petrodollar war of attrition that could escalate into a trade war between the two countries and a possible wider conflict beyond.

If a trade war between China and the United States erupts, China will not run from a fight with the United States and will retaliate by imposing its own sanctions on US exports. And to punish the United States financially, China could also offload its holdings of US Treasury bills estimated at $1.3 trillion.

There are good reasons, however, why a confrontation between China and the United States might not be permitted to escalate. Both great powers are aware that they risk losing so much from any conflict between them. And it will be more difficult to contain the aftermath of any new accident between them. In time, President Trump will realize that China will not bend the knee before him and stop his trade war against China and above all let the petro-yuan and the petrodollar find their niches in a global oil market big enough to accommodate them This is far better than damaging the global economy and themselves by a trade war.

It is probable that the Chinese yuan will emerge as the world’s top reserve currency within the next decade with the petro-yuan dominating global oil trade. This is something the Americans can’t stop short of a nuclear war.

*Dr Mamdouh G. Salameh is an international oil economist. He is one of the world’s leading experts on oil. He is also a visiting professor of energy economics at the ESCP Business School in London.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the position of ESCP Business School.

Facebook

Facebook Linkedin

Linkedin Instagram

Instagram Youtube

Youtube EMC Newsletter

EMC Newsletter