Nuclear energy is here to stay…

By Dr. Kostas Andriosopoulos

Even a nuclear disaster like Fukushima cannot wipe out nuclear reactors from the world. Accidents, proliferation, social unease and high capital costs, all indicate that nuclear energy cannot grow fast, though in general, this is the case with almost all energy technologies that mature and succeed each other over many decades. Eventually, nuclear will play a larger role in electricity generation, but it will get there slowly.

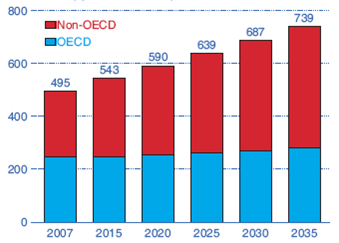

In a pre-Fukushima report, according to the BP Statistical Review of World Energy (2010), energy consumption in the OECD countries during 2009 fell faster than GDP, marking the first decline since 1928 and the sharpest decline (in percentage terms) on record. The developing world on the other hand, experienced an energy consumption growth faster than GDP. Looking forward, based on the reference case scenario of the International Energy Outlook (2010) report, world marketed energy consumption, total energy demand in the non-OECD and in the OECD countries is expected to increase by 49, 84, and 14 percent from 2007 to 2035, respectively. The latter two demand percentages pinpoint the increasingly high importance that emerging markets play in the world economy, especially during and after the global economic recession that started in 2007. Most of the growth in energy demand mainly stems again from the non-OECD countries that are also expected to have by far the highest growth in energy consumption compared to the OECD countries (see figure 1). Even though most of the developed countries seem to have exited the recession, the recovery has been mostly led by countries such as China and India, with Japan and the European Union member countries being the laggards.

Figure 1: World marketed energy consumption 2007-2035, Reference case (in quadrillion Btu).

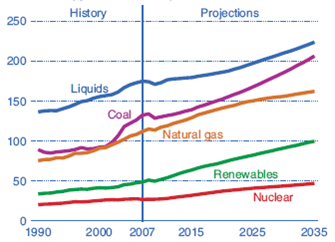

In addition, even though consumption of renewable and alternative energy sources is expected to increase in the future, most of the energy consumed worldwide is expected to come from fossil fuels, such as liquid fuels and other petroleum, natural gas and coal (see figure 2). Although energy prices collapsed in mid-2008 as a result of the worldwide concerns about the deepening recession, in 2009 prices bounced back and have remained high until now. The latter concerns about sluggish economic growth, in conjunction with certain geopolitical and non-geological[1] factors that limit access to prospective conventional resources, allowed unconventional resources such as oil sands, shale oil, gas-to-liquids, and bio-fuels to become economically competitive.

Figure 1‑2: World marketed energy use by fuel type 1990-2035, Reference case (in quadrillion Btu).

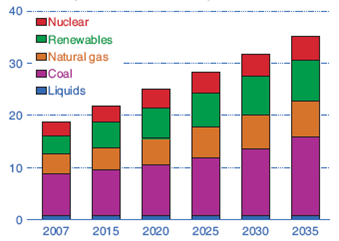

Moreover, increased concerns about the environmental consequences of greenhouse gas emissions, has led to increased interest in alternatives to fossil fuels such as nuclear power and renewable sources, mostly due to higher fossil fuel prices and the receipt of major support by governmental incentives throughout the world (see figure 3). However, most renewable generation technologies are not economically competitive with fossil fuels, besides hydropower and wind power that are mainly expected to deliver most of the world's increase in renewable electricity supply in the near future. Typically, renewable electricity generated by sources other than wind and hydro, such as solar, biomass, waste, tidal and wave, is primarily supported by government incentives or policies that fund the construction of renewable generation facilities.

Figure 3: World net electricity generation by fuel 2007-2035, Reference case (in trillion kwh).

No technology can solve the climate problem on its own. Hence, even if nuclear makes only a partial contribution towards global emissions reduction, it is definitely worth having. Based on calculations of the IEA's 2011 World Energy Outlook, keeping the 20 C limit plausible would cost an additional $1.5 trillion in case OECD countries were to stop building nuclear plants and other countries withdrew from their planned nuclear programs. To that end, there are strong indications from emerging markets that they will continue with their ambitious nuclear programs. China plans to add more nuclear capacity in the next ten years that France has in total, from 10GW to 80GW. Nonetheless, this will increase China's nuclear power generation only from 2% to less than 5% of the country's electricity needs; when South Korea gets some 30% of its electricity, much the same as Japan did pre-Fukushima, and more than any large economy other than France (Economist, 2012).

Finally, small modular reactors (SMRs) of up to 300MW seem to become even more popular, as they can reach markets which big reactors (more than 1GW) cannot. They can be installed in ships, both military and merchant, industrial zones etc. These small SMRs could potentially create economies of large numbers (i.e. if produced in factories and not on site), leading to significant cost reductions through incremental improvements, which would make them even more attractive.

Hence, there are strong indications that nuclear electricity generation is here to stay, and perhaps play an even larger role in the future, where challenges lie ahead for the world's climate problem.

[1] BP Statistical Review of World Energy, 2010. Available online at: http://www.bp.com/statistical review.

[2] International Energy Outlook, 2010. U.S. Energy Information Administration. Available online at: http://www.eia.gov/forecasts/ieo/index.cfm.

[3] International Energy Agency, 2011. World Energy Outlook. Available online at: http://www.iea.org.

[4] Economist, 2012. Nuclear Energy Special Report: The prospects. March 10-16, 2012. Available online at: http://www.economist.com.

[1] Non-geological factors include conflicts and terrorist activity, environmental protection actions, labour and material shortages, lack of technological advances, adverse weather conditions etc.

Facebook

Facebook Linkedin

Linkedin Instagram

Instagram Youtube

Youtube EMC Newsletter

EMC Newsletter