Electric Vehicles: Our Next Generation’s Cars?

The evolution of battery-powered vehicles

The coming of battery-powered cars has a long history. In 1799, the Italian Alessandro Volta established the scientific principles regarding storage of electricity in electrochemical form by putting two different types of metals—electrodes and the electrolytes—into contact, which led to the creation of the first electric cell. In 1859, the French physicist Gaston Planté developed the first acid battery. Electric vehicles (EVs) appeared with the advent of the automobile and accounted for one third of vehicles in the United States in the 1900s, before being displaced by more competitive internal combustion engines (ICEs) (1).

In recent years, there has been a rekindling of interest in EVs, as governments look to tackle carbon emissions from transportation sectors, contributing over 20% of total global emissions (2). The quest for energy independence and technological ownership are also factors driving government support for EVs (3). Norway and California have implemented subsidy programmes towards such ends. The United Kingdom and France have recently announced that they will ban the sale of fossil-fuel automobiles after 2040 (2).

The automotive industry

Car manufacturers that were initially sceptical about electric vehicles have now publicly announced plans related to the development of EVs. Volkswagen is planning to develop 80 new EV models by 2025, while Toyota aims to develop 10 new EV models by 2020 (2). Others, including Chrysler and Subaru, have announced that they will phase diesel cars out of their production lines by 2020 and 2022 respectively.

As a result, global sales of EVs have soared over the last decade, reaching 1.1 million units sold in 2017, compared to only a few thousand in 2010 (4). Although EVs still represent less than 1% of total new car sales, there are reasons to believe that we are entering a phase of EVs usage. Bloomberg New Energy Finance (5) predicts that sales of EVs will increase to 11 million by 2025, surging to 30 million by 2030.

“China is poised to lead the EV transition, with sales expected to account for 50% of the global EV market by 2025” - BNEF, 2018 (5)

Big-oil companies have been updating their electric vehicle forecasts continuously. OPEC has raised its expectations: In 2016 it predicted that 100 million EVs will be on the streets by 2040, but by 2017 that number stood at 266 million (6). The revisions are based on the remarkable technological improvements achieved in lithium-ion battery capabilities.

Will EVs replace ICEs in the future?

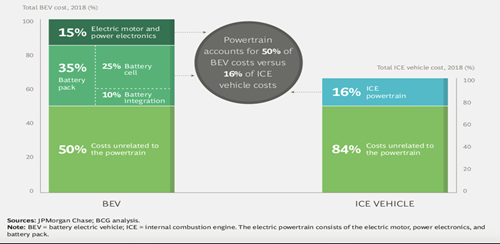

Before looking at recent developments of EV battery technology, it is key to understand the importance of the battery pack as a key component in their cost structure. EVs use electricity stored in a battery pack which contains electric cells to power the electric motor, thereby turning the wheels. According to the Boston Consulting Group (BCG), the electric powertrain—which includes electric motor, power electronics, and battery pack—accounts for 50% of an EV’s cost. By comparison, the ICE powertrain accounts only for 16% of a vehicle’s cost (Figure 1.) The battery pack itself constitutes the major cost, accounting for about 35% of the overall EV cost.

“Companies seeking to reduce the cost of EVs must look to reductions in the cost of battery packs in order to close the competitive gap with ICEs” - BCG, 2018 (7)

At present, there are several types of EV batteries on the market which are classified in terms of their chemical composition, however the most widely used for the production of EVs are lithium-ion batteries, the same used for laptops and mobile phones. This type of battery has the highest energy density (storage per kilogram) and durability (the number of discharge and recharge cycles) when compared to other types of batteries.

Commercialisation of lithium-ion batteries started in 1991 by the Japanese manufacturer Sony. It was initially used for the making of electronic components, lithium-ion batteries are now used to make EVs as well as stationary storage. As a result, the demand for lithium-ion batteries has increased dramatically. As competition between big battery manufacturers has intensified and battery supply capacity has increased, prices of lithium-ion batteries have lowered. From 2010 to 2016, battery pack prices fell roughly by 80% from $1,000/kWh to $227/kWh. Nevertheless, despite that drop, battery costs continue to make EVs more costly than comparable ICEs. Current projections put EV battery pack prices below $190/kWh by the end of the decade and suggest the potential for pack prices to fall below $100/kWh by 2030 (3).

Figure 1: BEVs are 35% More Expensive than ICE Vehicles (7).

It is challenging to predict exactly the “breakeven” price, and the battery price at which EVs will become competitive with ICEs. A price of $100/kWh for batteries is often presented as the objective to reach cost parity with ICEs (excluding incentives) (1).

Looking at the recent battery price reduction, it seems to be a clear path towards a future EV uptake that could eventually lead to the removal of government subsidies. Other key factors, such as battery improvements could help surging the demand for EVs by meeting consumer needs. Manufacturers need to overcome some technological challenges to boost demand.

Some EV models, such as the Nissan Leaf and the BMW i3, are limited to 100 miles per charge, while Tesla’s Model 3 has a range of 310 miles, albeit on a more expensive variant. Huge R&D investments have being made to improve battery power density and durability.

The challenges

Battery manufacturers are finding ways to tackle the “range anxiety” problem expressed by EV users which consists on running out of battery during long distance trips. Many attempts to improve battery range have resulted in an increase in the size of battery packs thus rendering them heavier and bigger (8). At present, manufacturers focus on reducing the size of batteries for smaller vehicles.

In February 2019, Tesla acquired the San Diego- based battery technology company Maxwell for over $200 million to incorporate dry electrodes technology into its lithium-ion cells. This new technology will allow Tesla to improve its battery cells’ power capacity retention by 90%, thus significantly improving its durability (9). In addition, Tesla and Panasonic have recently developed a cell named “2170” that will be “the most energy-dense battery on the market” according to Elon Musk (10).

At present, demand for EVs is falling behind EV battery production. Yet, manufacturers keep adding new production capacity to achieve economy of scale while complying with governments’ production targets. Boosting battery performance and affordability may lead to an overcapacity supply as big battery manufacturers—predominantly based in the Eastern hemisphere—that follow the Asian conglomerate model, sacrifice margins to increase market shares (11).

LG Chem is building a large-scale lithium-ion battery plant in Poland while Samsung SDI and SK Innovation are investing in Hungary. Whereas, the American manufacturer Tesla is building its Gigafactory in Nevada and plan to build another in Europe. As a result, some predict that by 2021, 40 percent of production capacity will be unused worldwide; hopefully this will inevitably force battery manufacturers to slash their prices (7).

General Motors’ Chairman and CEO, Mary Barra recently stated that her company car production was going “all-electric” but added that EVs, with their limited demand, would not make money until "early next decade (12).” Beyond lithium, there are other metals to consider. Lithium-ion battery cells contain not only lithium but also other raw material components, including cobalt and nickel.

A new “scramble for resources” is under way among battery manufacturers to secure enough raw material for a rapid expansion of production (6). These metals are highly sought to make EVs batteries, but also for stationary batteries. Although lithium supplies are still widely available, especially in South America (the world’s biggest reserves), new fields are being developed in Australia (13); however, other rare metals supplies are poised to become matters of strategic concern that could prevent further cost saving on EV batteries in the future.

As a result of this potential metal shortage, EVs car and battery producers are securing long-term contracts with metals producers. In 2017, Chinese car manufacturer Great Wall Motors signed a deal with Australian Pilbara Minerals to secure supply of the lithium for five years (13). Many hedge funds have also begun to take a keen interest in rare metals investment. Cobalt27, for example, a Canadian hedge fund, has invested billions of dollars in rare-metal stockpiles, expecting their prices to increase drastically in the future (14). Additionally, it would be interesting to keep an eye on the Democratic Republic of Congo’s economic development - one of the world’s poorest country- that contains more than 60 per cent of the planet’s cobalt reserves (15).

Nevertheless, EV battery makers aim to reduce their reliance on rare metal use in their electric cells, and improve overall performance. UK-based sustainable technology company, Johnson Matthey, has recently developed a battery material with higher performance using lithium and nickel but less cobalt. Another option could be recycling the raw materials present in old batteries. Significant R&D investments have been placed globally to outperform lithium-ion battery cells. Lately, improved chemistries have focused on advances in solid-state batteries technologies, such as lithium metal and lithium sulphur (16).

The EV revolution is well underway. EVs have become more affordable with the cost reduction of battery packs, despite not having reached cost parity with ICEs. Today, the main challenges for car and battery manufacturers are to reduce battery's price further, and improve technological performance in terms of density and durability. In the future, raw material supply constraints will be the biggest challenge to the development of EVs.

Victoria Di Pace is a student on ESCP’s MSc in Energy Management (MEM) and Vice President of the School's Energy Society Energy Society. If you want to pursue a career in the Energy industry and make a real impact in the sector, check out ESCP and its Energy Management programmes.

Useful links

ESCP Business School

MSc in Energy Management

Executive Master in Energy Management

References

1. BCG, 2018. The Future of Battery Production for Electric Vehicles, s.l.: s.n.

2. BNEF, 2018. Electric Vehicle Outlook 2018, s.l.: s.n.

3. Cobalt 27 Corp., 2018. Cobalt 27 Completes $200 Million Strategic Private Placement Offering. [En ligne]. Available at: https://globenewswire.com/news-release/2018/03/09/1420105/0/en/Cobalt-27-Completes-200-Million-Strategic-Private-Placement-Offering.html

4. Ferris, R., 2019. GM is going 'all-electric,' but it doesn't expect to make money off battery-powered cars until early next decade. [En ligne]. Available at: https://www.cnbc.com/2019/02/06/gm-doesnt-expect-to-make-money-off-electric-cars-until-next-decade.html

5. Jurgena et. al, 2017. Effects of change in the weight of electric vehicles on their performance characteristics. Agronomy Research, Volume 15, pp. 952-953.

6. IEA, 2018. Global EV Outlook 2018, s.l.: s.n.

7. Lambert, F., 2018. Tesla releases rare details about Model 3’s battery cells, claims highest energy density and less cobalt. [En ligne]. Available at: https://electrek.co/2018/05/03/tesla-model-3-battery-cells-rare-data-energy-density-cobalt/

8. Lambert, F., 2019. Tesla acquires ultracapacitor and battery manufacturer for over $200 million. [En ligne]. Available at: https://electrek.co/2019/02/04/tesla-acquires-ultracapacitor-battery-manufacturer/

9. Mathieu, C., 2017. Europe in the global race for electric batteries, s.l.: IFRI.

10. McKinsey&Company, 2017. Electrifying insights: How automakers can drive electrified vehicle sales and profitability, s.l.: s.n.

11. Sanderson, H., 2018. Electric cars: the race to replace cobalt. [En ligne]

Available at: https://www.ft.com/content/3b72645a-91cc-11e8-bb8f-a6a2f7bca546

12.Thakore, M., 2018. Speed bumps on the road to electrification. [En ligne]

Available at: https://www.ft.com/content/e996b74a-c631-11e8-ba8f-ee390057b8c9

13. The Economist, 2017. After electric cars, what more will it take for batteries to change the face of energy?.

14. The Economist, 2017. Australia is the new frontier for battery minerals. [En ligne]

Available at: https://www.economist.com/business/2017/11/25/australia-is-the-new-frontier-for-battery-minerals

15. The Economist, 2017. The death of the internal combustion engine. [En ligne]

Available at: https://www.economist.com/leaders/2017/08/12/the-death-of-the-internal-combustion-engine

Facebook

Facebook Linkedin

Linkedin Instagram

Instagram Youtube

Youtube EMC Newsletter

EMC Newsletter