$44 Trillion Needed to Meet Global Primary Energy demand by 2040

With oil prices ebbing and flowing against a background of OPEC and non-OPEC production cuts’ extension and US shale oil production inching up, nobody is paying enough attention to the fast-approaching oil supply gap.

Despite the recent dip in oil prices, industry experts are predicting a supply gap and rising oil prices by 2020. This is due in large part to an oil investment drought marked by almost three years of consecutive decline in oil prices, a statistic that has no precedent in the oil industry. This year a report by the International Energy Agency (IEA) projected that if oil investment remains stagnant over the next few years, by 2020 we will see a significant increase in the price of oil as global demand continues to climb.

Global investments in upstream exploration between 2014 and 2020 are projected to be $1.8 trillion less than previously assumed, according to leading US consultants IHS.

And by 2020, 15 million barrels of oil a day (mbd) of new supply may be needed to meet a projected annual average rise in global oil demand of 1.31 mbd and also offset an annual depletion rate in global oil production estimated by IEA at 5% or 4.8 mbd, which is virtually equivalent to losing the current output of Iraq.

A major underpinning factor for the projected steep rise in oil and gas demand is the growing world population and the emergence of megacities. ExxonMobil pointed out in its 2017 “Outlook for Energy: A View to 2040” some facts about the world’s population growth that could make you wonder if there could be enough oil or natural gas to meet the demands of the vast energy needs lurking over the horizon.

Twenty-five years ago there were only 10 urban areas in the world that could boast more than 10 million inhabitants. Now there are more than 37 so-called “megacities” worldwide. The megacities are topped right now by Japan’s Tokyo-Yokohama metroplex in which almost 38 million people live. That is three million more than the entire population of Canada. By 2040 the United Nations estimates that nearly 65% of the world’s population will call cities home.

ExxonMobil projects that global primary energy demand will rise by 25% from 13147 million tonnes oil equivalent (mtoe) in 2015 to 16434 mtoe in 2040. However, the IEA in its “World Energy Outlook 2016” tops ExxonMobil’s 25% demand increase, predicting a 30% rise in global energy demand by 2040.

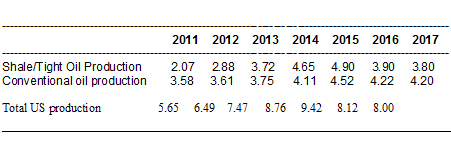

Worldwide crude oil supply and demand markets are close to balancing and will balance this second half of 2017. On the crude oil supply side, US shale/tight oil production peaked at 4.9 mbd in 2015 and has since fallen by over 1.1 mbd to 3.8 mbd in 2017 owing to high decline curve rates of 70%-90% associated with these shale/tight oil reservoirs (see Table 1).

Table 1

US Crude Oil Production

(mbd)

Sources: US Energy Information Administration’s (EIA) Annual Energy Outlook 2017

(AE02017) last updated in February 13, 2017.

According to the IEA, the world needs $44 trillion in investment in global energy supply between now and 2040 to meet the coming global energy needs with 60% or $26 trillion allocated for oil and gas production and supply, 20% or $8.8 trillion for renewable energy and the remaining $9.2 trillion for improvements in energy efficiency.

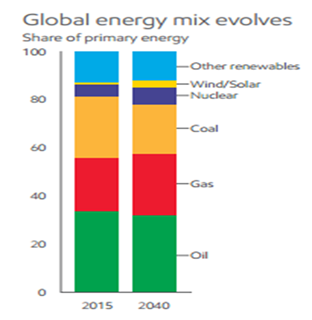

The global energy mix will not look much different for oil in 2040 according to Exxon Mobil’s “Outlook for Energy”. In 2015 oil accounted for 33% of the global primary energy consumption and it is projected to account for a similar rate even at 2040 despite rising demand and production (see Chart 2).

Chart 2

Source: Courtesy of Exxon Mobil 2017 Outlook for Energy

Natural gas is projected to grow the most of any energy type, accounting for a quarter of all demand by 2040. Coal will remain important but will lose a significant amount of its share as the world transitions to cleaner energy.

A lack of investment will cause oil production to decline steeply and 80% of the current new oil supply is needed to offset natural declines.

The oil industry desperately needs new sources of oil, and they need new investors and technologies to find those sources quickly.

*Dr Mamdouh G. Salameh is an international oil economist. He is one of the world’s leading experts on oil. He is also a visiting professor of energy economics at the ESCP Business School in London.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the position of ESCP Business School.

Facebook

Facebook Linkedin

Linkedin Instagram

Instagram Youtube

Youtube EMC Newsletter

EMC Newsletter