In the first quarter of 2020, the oil market was as turbulent as a hurricane hurting the US Gulf Coast. The dramatic collapse of oil demand pushed oil prices to new territories. The situation sets a gloomy future for weaker oil producers in the upstream sector. This led to a fragile coalition between crude oil producing countries.

Figure 1: Weekly crude oil price for Brent and WTI

Global situation on the supply side

On March 6, as the demand collapsed, OPEC+ members had to conduct a meeting to decide to cut a portion of their domestic oil production [1]. Meetings like this are not unusual in the OPEC decision-making system but this time it was different as they had to agree on the biggest cut in oil production ever made. The talks collapsed as Russia, which is not an original member but was invited to the talks since 2017, did not agree with the OPEC members to reduce the output. This decision led to a decline of the oil price from $45.27 for Brent the day of the meeting to $22.76 on March 30.

In April, WTI fell into negative territory for the first time in history, obliging producers and traders to pay buyers to take oil off their hands. The reason is that storage capacity at Cushing, Oklahoma was just weeks away from full capacity. This location is a landlocked choke point where traders have to take physical delivery of crude oil. WTI rebounded to around $15/barrel during the following days [2], still far away from the $45 to $50/barrel required by the shale industry to break even [3], meaning that below this threshold, oil producers are losing money as they cannot cover their fixed and variable costs.

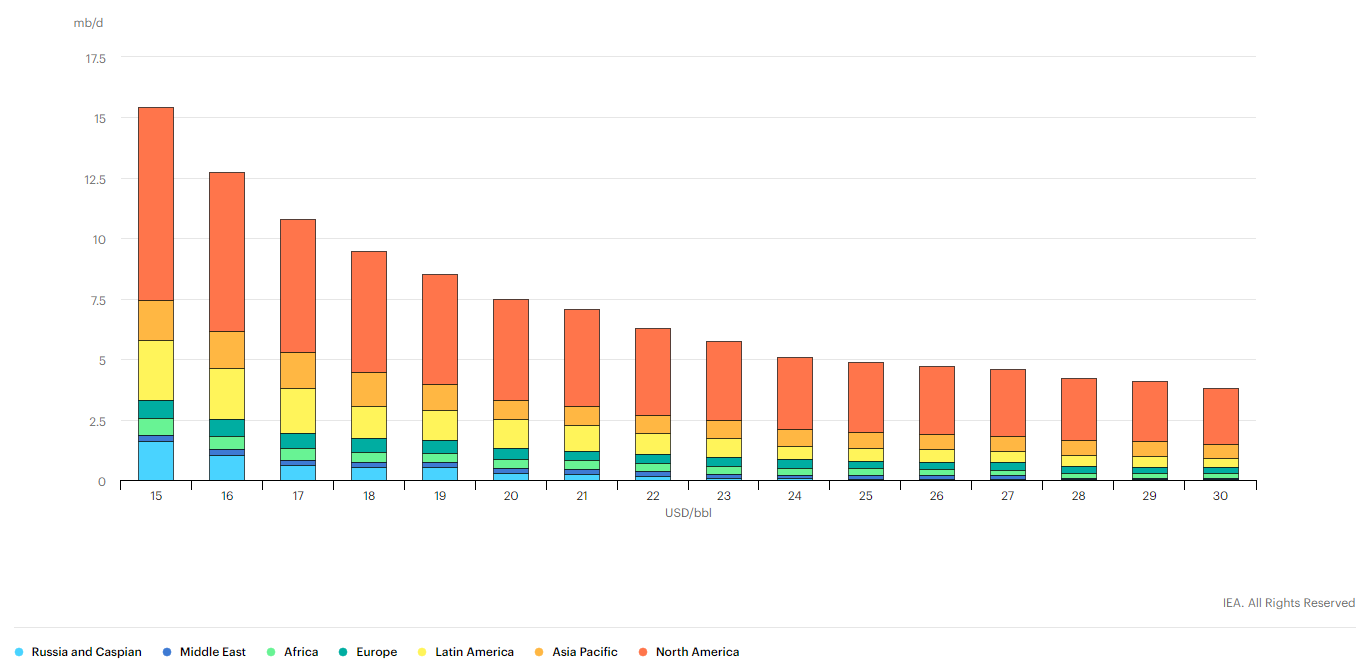

Figure 2 : Location of oil production that is uneconomic at different Brent prices

The main regions at risk with a persistent low price for oil are the ones with a higher cost of production per barrel or producing lower quality crude oil.

Situation for oil-producing countries

North America is particularly exposed to oil crisis, with shale in the US requiring 45-55$/barrel to break even and make a profit and tar sands in Canada requiring 60$/ barrel to break even and make a profit. Other countries like Russia and Saudi Arabia are more protected against a drop in oil price. Saudi Aramco (National Oil Company from Saudi Arabia) has a cost per barrel of 2.80$ and Rosneft (National Oil Company from Russia) is profitable even with a barrel of Brent trading at 10-15$.

Despite having very low production costs, Russia and Saudi Arabia need a sustained oil price at acceptable levels (above 60$/bbl) as oil accounts for a large share of their GDP. In Russia, 40% of the state’s budget comes from oil and gas revenues while in Saudi Arabia, it’s close to 70%.

One can easily understand that even if NOC companies from these two countries are profitable at extreme low prices, their economies are extremely sensitive to oil volatility. The state budget differs considerably year-on-year and this may have an impact on the services provided such as budget for ministries, subsidies for companies, social benefits for citizens, domestic projects and so on.

A particularly representative example is to compare the price of Brent between 2014 to 2016 and Saudi Arabia’s GDP over that period. When Brent fell from 110$ a barrel to less than 50$ during these 2 years, Saudi GDP fell from $756 billion in 2014 to $645 billion in 2016, equivalent to a 15% drop.

Situation for oil-producing companies

For private companies such as the oil majors (Exxon Mobil, Chevron, Shell, BP, Total), the situation materializes as a stress test for the industry. Companies exposed to this historical low oil price need to postpone or cancel some of their future projects in order to reduce their expenses in times of uncertainty. This may also result in less dividends paid to shareholders as companies have to re-examine the allocation of their free cash flow.

Large corporations are more resilient to these shocks as they have accumulated tremendous wealth over the past decades. Things are more complicated for smaller independent upstream oil companies, relying on a higher cost of production and debt. As the Figure 2 shows, the lower the price of oil, the more exposed oil producers (particularly US producers) are. The recent surge in the shale industry was only possible because Wall Street and bankers supported companies a few years ago and provided them with easy-to-access loans to drill across Texas or the Appalachian Mountains. But the bill is coming due for this industry, with $200 billion of debt maturing over the next four years and bankruptcy looming ahead for several shale players [4].

The US is particularly hit by consistent low prices due to the impossibility for its oil industry to break even with a barrel below $45-50. The longer term view should be more promising for oil producers, due to the easing of global lockdowns, voluntary cuts in oil production for some, forced ones for others. One should keep in mind that the end of the epidemy is unknown as well as the recovery of the demand. Only the most robust oil producers will make it through this period of uncertainty, with State aids for most of them.

Future outlook for the oil market

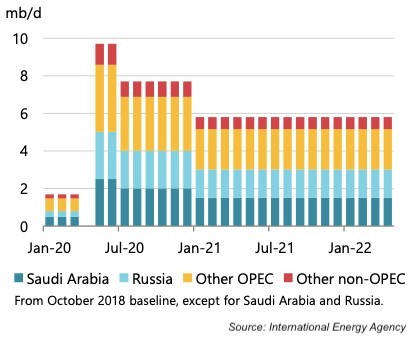

The original OPEC members, alongside Russia and some non-OPEC countries, decided in April to cut oil production by 9.7 million barrels per day at a May-June horizon. Each of the countries involved in this historical deal will have to reduce their own domestic production to match the metrics from the Figure 3. Saudi Arabia and Russia will take most of the burden by removing more than 2 million barrels per day of their own production from the market. This strategy is aimed at driving oil prices to more sustainable levels to ensure that the oil industry will make it through this crisis and to fund the states that rely on the “black gold” to fund their domestic policies. The projected oil cuts are supposed to last for some time. The idea is that, when demand is back to normal levels, oil producers will benefit from a rising, profitable oil price.

Figure 3 : OPEC+ Production cuts

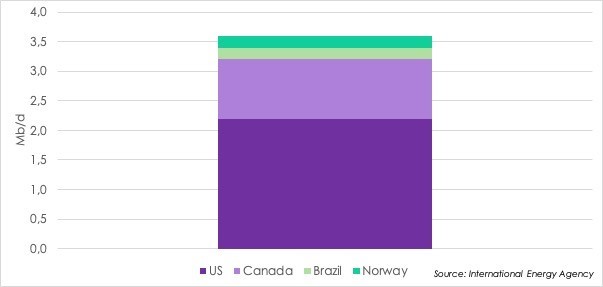

On the non-OPEC side, some cuts in the oil production are likely, but it is not clear to which extent and if it will be voluntary or driven by market forces as the US suggests. The US and Canada in particular will be forced to decrease their production due to the low oil price environment. American production reached almost 13 million barrels per day at the end of 2019 but the Energy Information Administration warned that output will be down to 11 million barrels per day by 2021. According to one of the biggest shale producers in the US, Pioneer Natural Resources, output could be reduced by 3 million barrels per day with a $35/barrel environment and by 7 million barrels per day with a $10/barrel environment, highlighting the sensitivity of the US oil industry to oil crises. Even if the US, Canada, Norway and Brazil agreed that global oil cuts are required to maintain oil prices at a certain threshold, it is not certain whether their own reduction will result from a Government-driven decision or by the market itself.

Figure 4: Expected declines from other key producers

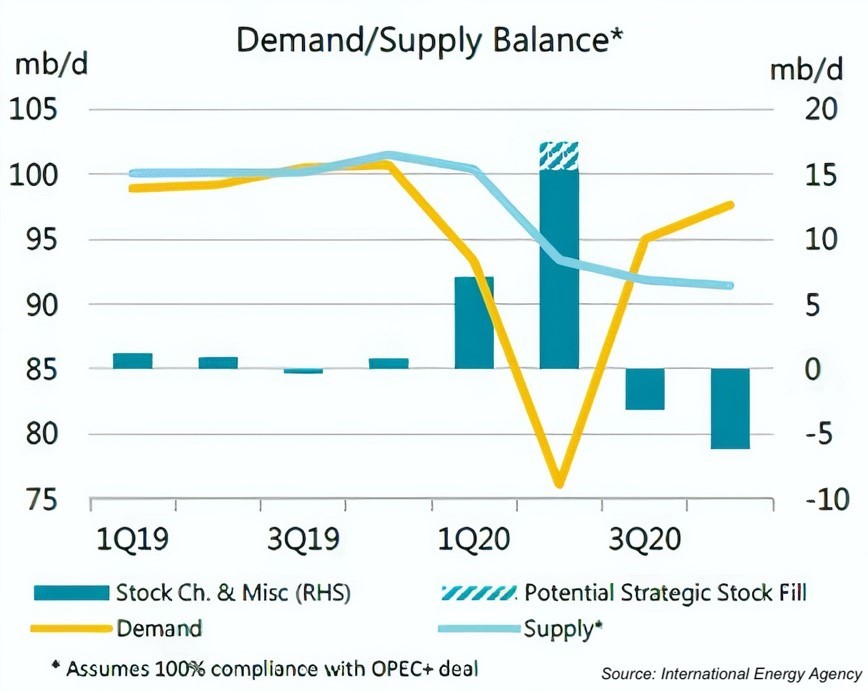

Based on the estimated oil cuts, global oil supplies should decrease by almost 10% compared to their pre-crisis level through 2020 [5], the biggest drop ever observed in the oil sector. According to the International Energy Agency, by the end of the third quarter of 2020, oil consumption will rise steeply, due to the expected recovery of the economy and the end of lockdown measures. As the graph suggests, the rebound of demand will surpass oil production as the decided oil cuts are not supposed to end by 2020. This means that potentially, the price of oil may rise to levels seen before the crisis, close to $60 per barrel or even higher depending on the level of oil inventories and the length of the oil cuts. The oil industry severely suffers from the ongoing crisis, but the $100/barrel era is maybe not gone forever.

Figure 5 : Oil Demand/Supply balance

Sources

[1] Kopits, S., 2020. Saving The US Shale Sector: An OPEC Super Deal - American Greatness. [online] American Greatness. Available at: <https://amgreatness.com/2020/04/26/saving-the-u-s-shale-sector-an-opec-super-deal/>

[2] MarketWatch. 2020. Crude Oil WTI (NYM $/Bbl) Front Month. [online] <https://www.marketwatch.com/investing/future/crude%20oil%20-%20electronic>

[3] Brower, D. and Sheppard, D., 2020. Will American Shale Oil Rise Again?. [online] Ft.com. Available at: <https://www.ft.com/content/2d129e4a- 860b-11ea-b872-8db45d5f6714>

[4] Dezember, R., 2020. Energy Producers’ New Year’S Resolution: Pay The Tab For The Shale Drilling Bonanza. [online] WSJ. Available at: <https://www.wsj.com/articles/energy-producers-new-years-resolution-pay-the-tab-for-the-shale-drilling-bonanza-11577880001>

[5] IEA. 2020. The Global Oil Industry Is Experiencing A Shock Like No Other In Its History – Analysis - IEA. [online] Available at: <https://www.iea.org/articles/the-global-oil-industry-is-experiencing-shock-like-no-other-in-its- history?utm_content=bufferbd0a3&utm_medium=social&utm_source=linkedin-Birol&utm_campaign=buffer>

Research Topics: Energy Markets’ Volatility

Facebook

Facebook Linkedin

Linkedin Instagram

Instagram Youtube

Youtube EMC Newsletter

EMC Newsletter